pay utah state property taxes online

What if I dont know my Parcel Number. Corporations fill out form 1120-W.

John S Kiernan Managing Editor Feb 23 2021.

. The effective property tax rate in Colorado is low but higher home prices mean homeowners will pay 2343 on a median-priced homethe highest tax burden dollar-wise of any state on our list. ACH Agreement Change Form. Of course Utah taxpayers also have to pay federal income taxes.

At the time of this writing the only states that do not charge a state income tax are Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. If you live or earn money in one of the other 41 states or the District of Columbia you may need to file a state income tax return by the filing deadline. A disabled veteran in Utah may receive a property tax exemption on hisher primary residence if the veteran is 10 percent or more disabled as a result of service.

You may request a pay plan for business taxes either online at taputahgov over the phone at 801-297-7703 800-662-4335 ext. All taxpayers in Utah pay a 495 state income tax rate regardless of filing status or income tier. Contact your county treasurer for payment due dates.

Click Here to Pay. ATTOM Data Solutions provides a county-level heat map. If the tax bills are mailed late after May 1 the first installment is.

7703 or by sending in form TC-804B Business Tax Payment Agreement Request to the Utah State Tax Commission. Therefore its crucial to thoroughly research property taxes at both the state level to get a general idea of a states level of taxation and a very specific local level for an area. 74 State House Dist.

In most counties property taxes are paid in two installments usually June 1 and September 1. Property Tax Inquiry Before making your payment please contact the Sheriffs Office at 337 394-2539 for your amount. Once you pay off your house your property taxes arent included in your mortgage anymore because you dont have one.

Please contact us by email or call us at 801-851-8255. Governor Attorney General State Auditor State Treasurer State Senate Dist. How often you pay property taxes depends on where you live.

Taxes Become Delinquent After November 30 Each Year. Feb 13 2021 Sep 12 2020. For federal taxes you can calculate your estimated tax by filling out an IRS form.

Your property serial number Look up Serial Number. This raised 323 billion in property taxes across the nation. In 2019 homeowners paid an average of 3561 raising 3064 billion.

Your business personal property account number. For non-profit corporations the deadline for filing federal tax returns is 75 days after the end of their fiscal year. If November 30th falls on a weekend the due date is the following business day.

Active duty armed forces personnel may receive a full property tax exemption if heshe is deployed out-of-state for. 29 State House Dist. You may pay directly to your states tax agency such as on your state tax return.

LINKS Tax Information Search Property Information Search Utah State Tax Commission ACH Authorization Form. To pay Real Property Taxes. 100 East Center Street Suite 1200 Provo Utah.

Each state and tax collector determines their process for collecting delinquent taxes as well as the exact process for how a tax deed sale works. Depending on where you live property taxes can be a small inconvenience or a major burden. Tax Notice Assessment Number required.

Utah Property Tax Rates. Out of that number 19 are merged into boroughs while the rest are incorporated as cities. To pay Business Personal Property Taxes.

Payments received after NOVEMBER 30 th or the first business day after the 30 th if November 30 th falls on a weekend are subject to a per parcel penalty of 25 or 10. No cities in the Beehive State have local income taxes. John S Kiernan Managing Editor Feb 23 2021.

Utah has a very simple income tax system with just a single flat rate. Homeowners have to pay these fees usually on a monthly basis in combination with their mortgage payments. OneStop Business Registration OSBR Register your business with multiple Utah agencies all in one location.

Most HOAs have a fiscal end date of December 31 the last day of the. Some states like Florida offer tax deed sales in which the winning bidder has the right to take. To determine whether your HOA needs to pay state taxes it is best to check with a CPA.

There are more than 1000 different property tax areas in Utah each with a separate rate. 62 State House Dist. For state taxes you can usually contact your states department for revenue or taxation to find requirements and forms.

Tom Durrant 87 North 200 East STE 201 St. In some cases you make payments into an escrow account that your mortgage lender then uses to pay your property. The difference is how you pay your property taxesand when you pay your property taxes.

What you need to pay online. Property taxes can vary significantly from state to state leading to a difference of potentially thousands of dollars in a homeowners bill for essentially identical properties. Property taxes or real estate taxes are paid by a real estate owner to county or local tax authoritiesThe amount is based on the assessed value of your home and vary depending on your states property tax rateMost US.

President and Vice President US. Property Taxes by State. Fifteen out of 19 boroughs and.

If November 30th is on Saturday the due date is December 2nd. 71 State House Dist. The maximum taxable value of a property is 271736 and the veteran must be 100 percent disabled.

Aggregate Local Property Tax Stats. If approved you will receive an email confirming the acceptance of your request. Enter your address into the search bars on the Cache County Core website.

Utah State Statute 59-2-1331. Even though Alaska is the largest American state only a portion of it is subject to a property tax. Some places collect property taxes quarterly semi-annually or annually.

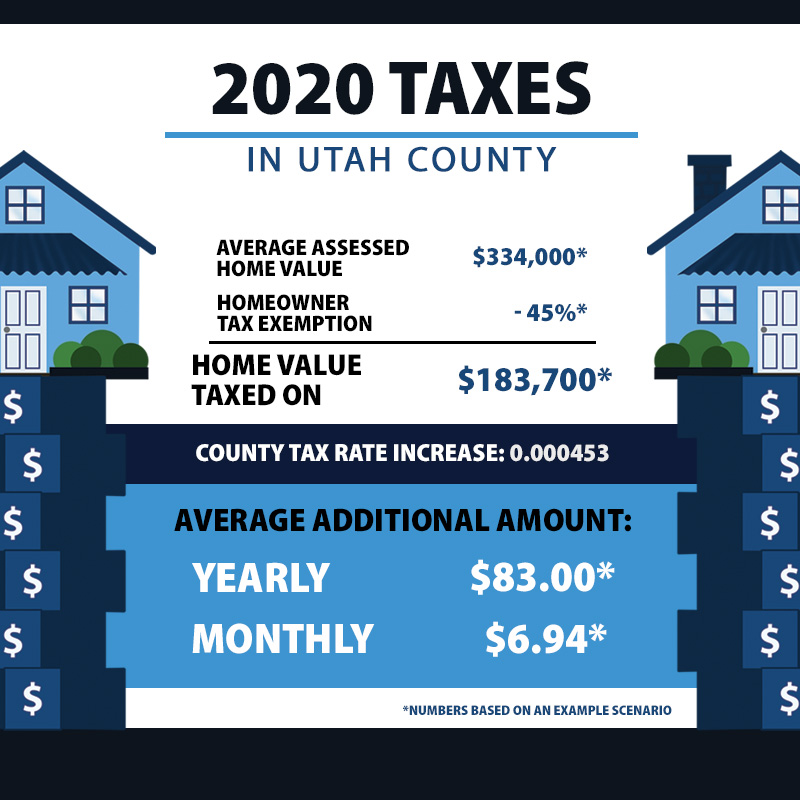

Yet there is an easy way to pay your Alabama property taxes online. General Election Results are scheduled to begin posting online on Tuesday November 3 2020 at 800pm Mountain Time. These areas are a product of the fact that counties cities school districts and water districts can all levy property taxes.

The state has about 321 communities 165 of which are incorporated. When how to pay property taxes. Taxpayer Access Point TAP Register your business file and pay taxes and manage your online account.

The total of the rate between all the applicable tax authorities is the rate that homeowners pay. George UT 84770 435 634-5703. Starting Dissolving or Reinstating a.

In 2020 the average single-family home in the United States had 3719 in property taxes for an effective rate of 11. Now its on you to pay property taxes directly to your local government. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah.

Overview of Utah Taxes. Your HOA accountant can also help with filing federal HOA tax returns. When Should an HOA Pay Taxes.

Census Bureau and residents. The average American household spends 2471 on property taxes for their homes each year according to the US. Individuals sole proprietors partners and S corp shareholders fill out Form 1040-ES.

Property Taxes by State. Please contact us at 801-297-2200 or taxmasterutahgov for more information. It is a separate and.

Property Taxes are due NOVEMBER 30th at 500 PM. Paying someone elses delinquent property taxes can pay off if its done right. Similarly how you pay depends on where you live.

The phone number should be listed in your local phone book under Government County Assessors Office or by searching online. 2 Governor and Lt.

Pay Utah County Real Property Taxes Online

Utah Property Taxes Utah State Tax Commission

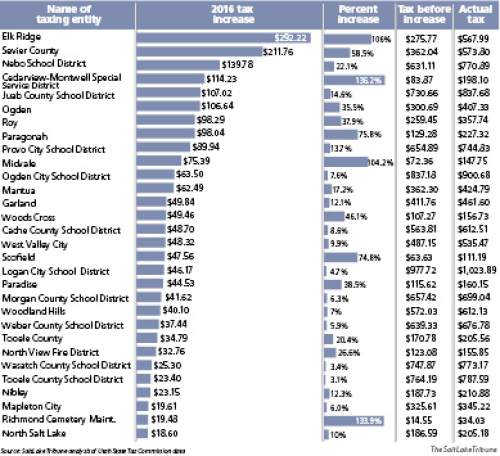

Despite Fuzzy Claims 53 Utah Local Governments Are Proposing Property Tax Hikes The Salt Lake Tribune

Utah State Tax Commission Official Website

Pay Taxes Utah County Treasurer

Utah Sales Tax Small Business Guide Truic

Property Taxes When To Consider An Appeal Choose Park City Real Estate

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19627124/0126tXGR_tax_advance_02.jpg)

Very Strong Negative Response To Utah Tax Reform Pollster Says Deseret News