45l tax credit multifamily

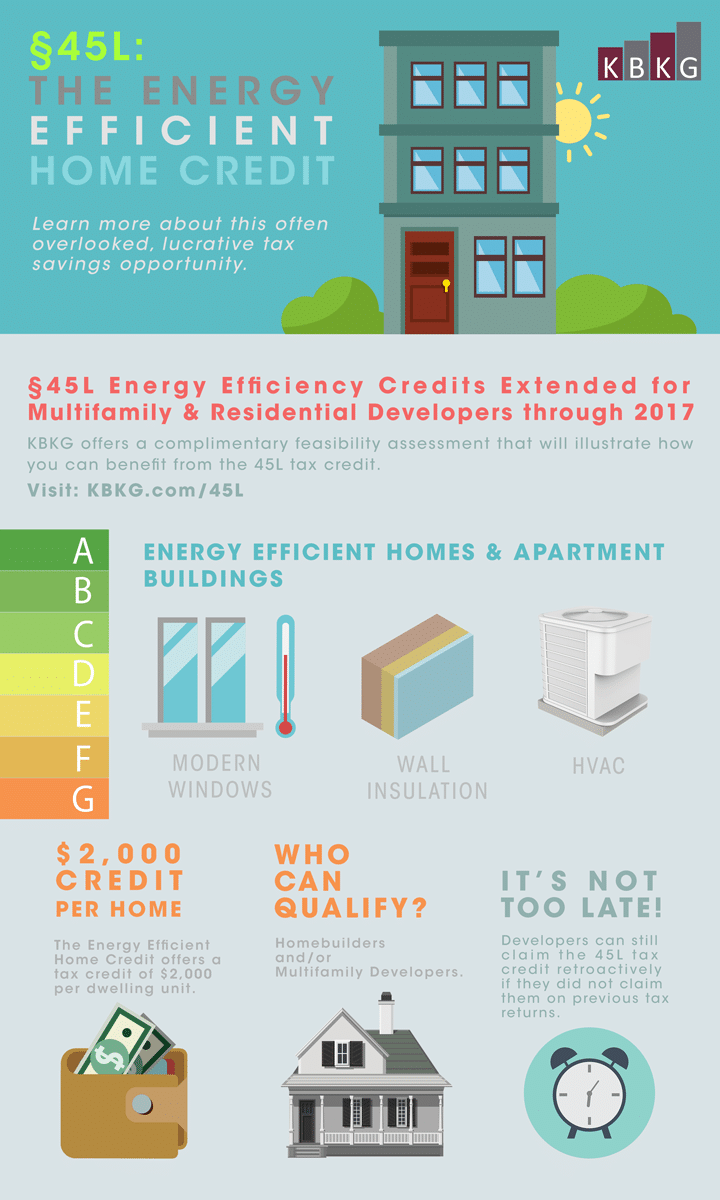

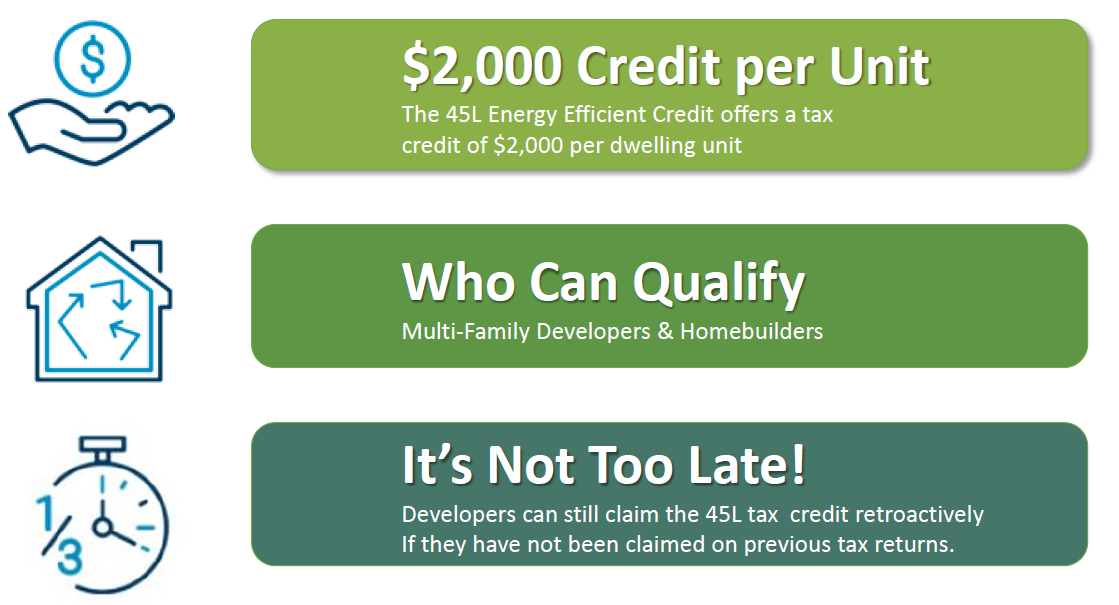

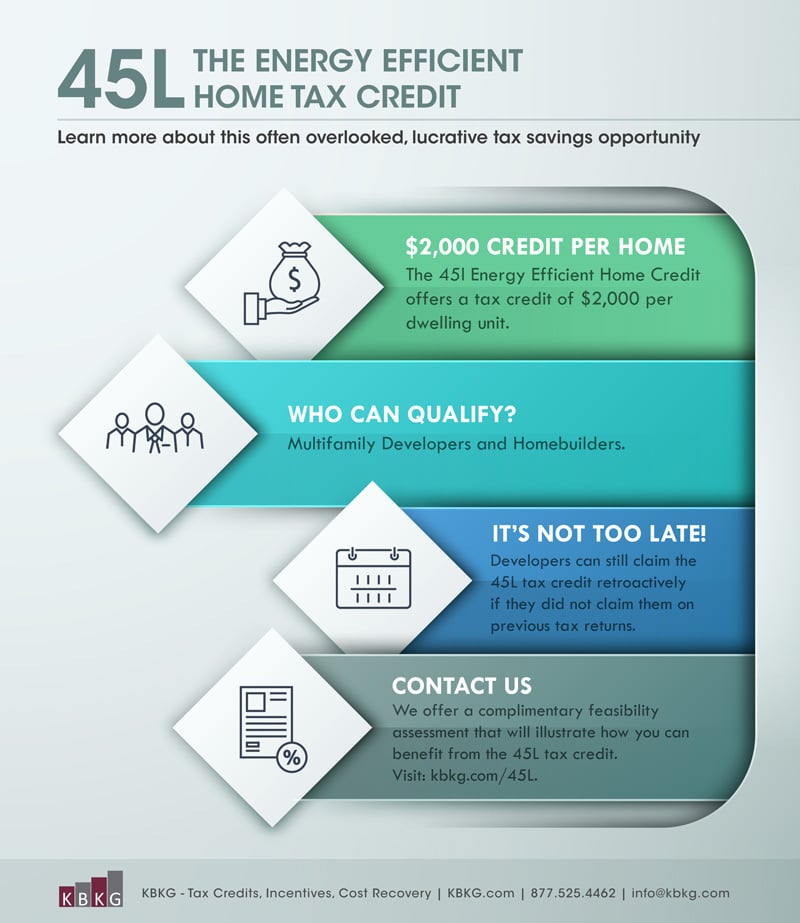

The tax credit is 2000 per dwellingper unit and can be claimed by the builderdeveloper s of an energy-efficient home. What is the 45L Tax Credit.

Nahb Policy Briefing Changes To 45l Tax Credit Pro Builder

A tax credit of 2000 per dwelling unit is available for qualifying properties.

. Among other extensions this bill retroactively extends the Code Section 45L tax credit providing multifamilyapartment builders with a tax credit of 2000 per energy efficient unit. The 45L Tax Credit applies to single-family homes as well as apartment complexes assisted living facilities student housing and condominiums. The 45L tax credit is an energy-efficient tax credit for residential properties.

These types of projects are eligible for the 45L tax credit. Its ability to be applied to substantial reconstruction and rehabilitation as referenced in the Section 45Lb3 is often overlooked. Section 45L is a little-known tax credit that offers developers a means to offset the costs associated with building energy-efficient single family or multifamily properties.

45L Federal Tax Credit. Developers and builders of single-family homes and multifamily buildings may benefit from recent legislation extending the Section 45L Energy Efficient Home Credit. If you are a developer that has built a low-rise multifamily property the 45L tax credit could benefit your company.

The 45L tax credit for energy-efficient homes provides 2000 per unit for owner-occupied or rental dwelling buildings that meet certain conditions. The tax credit is 2000 per residential dwelling unit. This credit was extended retroactively in late 2019 for 2018 and 2019 thru December 31 2020.

Available for single-family multi-family less than 3 stories homes sold 2017-2021. The credit provides a dollar-for-dollar offset against taxes owed or paid in the tax year in which the property is sold or leased. Recent tax legislation extended the Energy Efficient Home Credit to developers of energy-efficient homes and apartment buildings.

Through recent passage of a new tax extenders bill the energy efficient home credit the 45L credit which provides eligible contractors with a 2000 tax credit for each energy efficient dwelling unit is retroactively available for projects placed in service from 2018 to 2020 and through the end of. The 45L Tax Credit originally made effective on 112006 offers 2000 per dwelling unit to developments with energy consumption levels significantly less than certain national energy standards. Single family and custom spec homes duplexes ADUs apartments condominiums multi-family projects 3-stories above grade and less.

Buildings placed in service between 2018 and 2020 are eligible. 45L Tax Credit Viridiant is here to help you get a 2000 tax credit per unit on your property. 45L Tax Credits For Multifamily Dwellings Tax Credit for Energy Efficient Residential Buildings The New Energy Efficient Home Tax Credit Code Section 45L has been extended to December 31 2011.

Builder 2000home 45L Energy Efficient Tax Credit. Each newly contractor built energy efficient residential dwelling purchased from the contractor and used as a residence over the last few years is eligible for. Properties which must be three stories or lower must incorporate energy-efficient features such as high R-value insulation and roofing HVAC systems andor windows and doors.

Single-family Homes Apartments Condos Townhouses Home Builders. Key provisions impacting the multifamily industry include the following. Who can benefit from 45L Tax Credits.

The Section 45L tax credit had expired at the end of 2011 but this bill extends the tax credit for two years through 2013. 45L Tax Credit 45L is for residential and multi-family properties. The Section 45L tax credit is a credit that offers developers a means to offset the costs associated with building energy-efficient single family or multifamily properties.

Section 45L or Energy Efficient Residential Tax Credit has been recently extended through the end of 2021. If youre renovating or rehabbing a multifamily property with three-stories or feweror have previously done soyou could be eligible for the 2000unit tax credit if the improvements both. 45L Tax Credit for Multi-Family Apartments Home Builders The 45L Tax Credit is a valuable tool that provides builders and developers with tax credits for residential and apartment buildings.

And you could receive a 2000 per unit tax credit. The Act has extended the 45L credit for qualifying units initially leased or sold through December 31 2021. OUR SERVICE Our 45L Tax Credit team includes HERS raters and tax professionals who will perform free assessments to prequalify your homes.

This credit provides a dollar-for-dollar offset against taxes owed or paid in last three years on property sold or leased. Housing units must have at least one room a kitchen a living room and a sleeping area. Because the 45L tax credit is paid per housing unit it has the most significant impact on multi-family housing projects such as apartments condominiums townhomes student housing as well as assisted living facilities.

Section 45L Energy Efficiency Credits Low-rise three-story and below apartment developers are eligible for a 2000 tax credit for each new or rehabbed energy efficient dwelling unit that is first leased. You could claim 2000 for a single-family home or 1000000 for the 500 units in your recently completed condominium project. The Section 45L tax credit which rewards multifamily developers with tax credits of 2000 per energy efficient apartment unit.

Taxpayers also have the ability to amend returns to claim missed tax credits from previous years. Each unit in a multifamily residential facility may qualify. 45L is a federal tax credit for energy efficient new homes Under the provisions of the 45L New Energy Efficient Home Tax Credit builders and developers can claim a 2000 federal tax credit for each new home or dwelling unit that meets 45L energy efficiency requirements.

The bill extends the tax credit for another two years through the end of 2013 and can be claimed by any eligible contractor on From 8908. Multi-family units up to three stories high are. There is no limit to the number of residential units for which you can claim the 45L tax credit as long as the homes meet the required standards of energy efficiency.

The 45L credit which previously was set to expire on December 31 2020 allows the eligible contractor of a qualified new energy-efficient dwelling unit a 2000 tax credit in the year that unit is sold or leased as a residence. In many states most new residential projects qualify for this credit. Most eligible multi-family projects qualify for the 2000 Energy Efficient Home Tax Credit due to strict California building code.

Department of Energy approved software CHEERS uses Micropas a Department of Energy DOE approved software to create 45L certificates. The 2000 tax credit per building unit is available to developers and builders of properties that are 50 more energy-efficient than a similar property built in 2006.

Eve Yu R D Tax Credit Manager Kbkg Tax Credits Incentives Cost Recovery Linkedin

45l The Energy Efficient Home Credit Extended Through 2017

Section 45l Tax Credit Case Study Apollo Energies Inc

Tax Credit Extended For Home Builders Multifamily Developers Bkd

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

2021 Available Tax Incentives For Energy Efficiency Cova Green Homes

45l Tax Credit Energy Efficient Tax Credit 45l

Asset Environments News Updates Asset Environments

Affordable Housing Developers Investors Additional 2 000 Tax Credit

45l Tax Credit Energy Efficient Home Credit For Developers Baker Tilly

Nahb Policy Briefing Changes To 45l Tax Credit Pro Builder

Tax Benefits For Multifamily Rehabilitation Property Projects

Tax Benefits For Multifamily Rehabilitation Property Projects

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

179d Tax Deductions 45l Tax Credits Source Advisors

Tax Credits For Multifamily Dwellings 45l Tax Credit Engineered Tax Services

Kbkg Tax Insight Bipartisan Bill Proposes Retroactive Extension And Updates To 45l Tax Credit Through 2022

Section 45l Tax Incentive For The Real Estate Industry Extended Through December 2020 Tax Point Advisors